We position ourselves as your leading strategic ally in wealth protection and financial internationalization advisory and consulting services, specifically oriented to a distinguished high-profile clientele in Latin America. Our experience in this segment makes us stand out, offering solutions that transcend borders and safeguard your wealth. We work tirelessly to provide you with a comprehensive approach to ensure the security and optimization of your assets in a global environment. Your success and peace of mind are our top priority, and we are committed to providing you with personalized guidance in the management of your financial and wealth affairs. Let your financial future prosper with our support, backed by years of experience and ever-evolving expertise. Trust us to take your wealth across borders and into new opportunities.

Portfolio internationalization.

- Restructuring and adequate conformation of a portfolio.

- Currency devaluation as a determining factor "Country Risk".

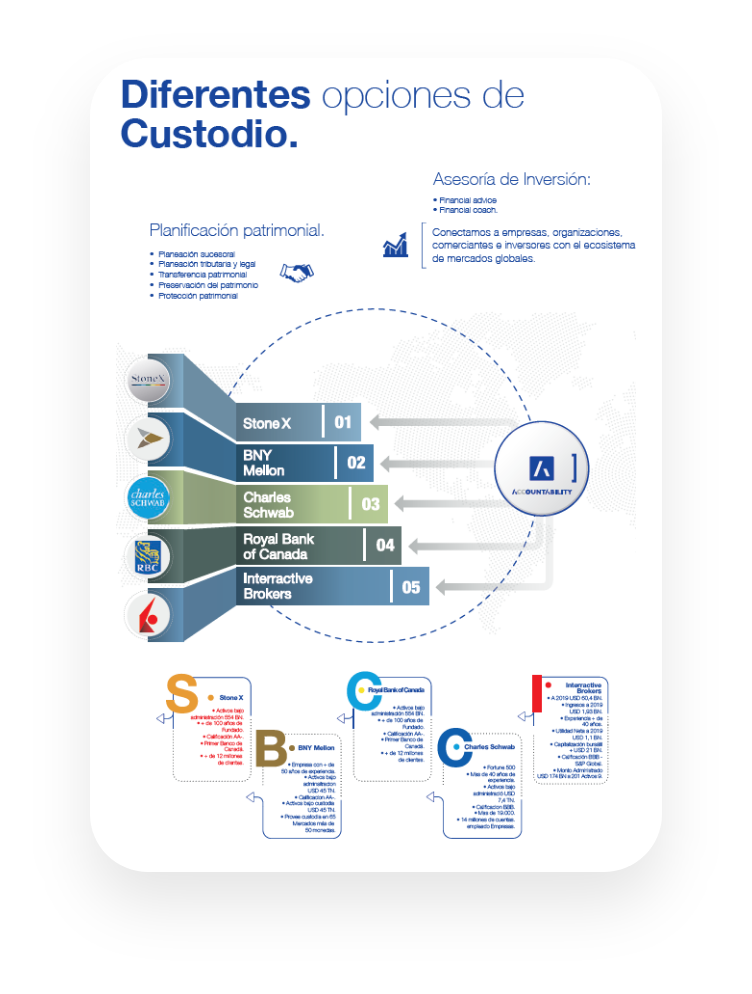

- Direct access to custodians and global investment funds.

- Unconventional investments: global real estate funds.

- Latest technology in rebalancing and asset management.

Estate Planning

- Succession planning.

- Tax and legal planning.

- Equity transfer.

- Heritage preservation.

- Heritage protection.

Equity Risks.

- Contractual and Extracontractual Liability.

- Successor Risks.

- Tax Risks.

- Security risks: country risk, information leakage, loss of confidentiality.

Financial Internalization: Protecting Family Wealth

Families are unaware of the need to build and develop a financial internalization plan as a wealth protection strategy and as part of their financial and succession plan.

- Our work team and its combined experience in the local and international market, as well as its values, are intangible elements that are not easily replicated by other organizations.

- Assistance: We have an expert team, financial operations manager; each member of the team has the commitment, proactivity and responsibility to carry out each of the processes and financial operations that we have in the portfolio.

Spanish

Spanish English

English

Contact Us

Contact Us

9542973770 - 9548253639

9542973770 - 9548253639